Credit Card Charge Reading Sp * Guiolp,wilmington,de,

The cofounder of Microsoft ranks equally America'due south largest private farmland owner. By Eric O'Keefe Telephone call it a hunch, merely the story did non jibe. I scanned the headline for the umpteenth time and and then read and reread the pertinent details.…

The cofounder of Microsoft ranks every bit America'due south largest private farmland owner.

By Eric O'Keefe

Telephone call it a hunch, simply the story did non jibe. I scanned the headline for the umpteenth fourth dimension and and so read and reread the pertinent details. Something was missing. Either that or I had a screw loose. According to reporting by Wendy Culverwell in the Tri-Metropolis Herald, a 14,500-acre swath of pick Eastern Washington farmland in the Horse Heaven Hills of Benton County had simply traded hands for almost $171 one thousand thousand. That's a ginormous deal, 1 that pencils out to nearly $12,000 per acre for a whole lot of acres. Pretty pricey dirt, right? That's exactly what I thought. Especially when it comes to row crops similar sweet corn and wheat, which were grown in rotation with potatoes on 100 Circles, which is the name of the belongings that changed hands. Then again, farmers and investors in the Mid-Columbia River market expect to pay $x,000 to $xv,000 for adept ground. Anyone who has ever studied the Columbia River Basin knows that the tillable acreage at that place is coveted ground, a geologic wonder. The soil profile and underlying silty loess are in a league of their ain.

I had gained this smidgen of geologic proficiency while researching our 2018 Farmland Deal of the Year, Weidert Farm, in neighboring Walla Walla County. I of the most telling moments in the field that summer came when a soil scientist by the name of Alan Busacca grabbed a shovel and stepped into a 10-pes trench that had been ripped open on the farm by a Caterpillar 336. Dusky layers of silt and sand towered over the 6-foot-tall retired Washington State professor. There wasn't a rock, let alone a pebble, or even a root to be seen in the soil. Busacca was in his element: It was some of the richest farmland in the Lower 48. And from an agricultural perspective, the region surrounding Walla Walla and the Equus caballus Heaven Hills has evolved into a commercial hub, complete with controlled atmosphere (CA) storage, state-of-the-art transportation infrastructure, and ready admission to low-toll hydropower.

These are a few of the reasons why savvy investors accept been plowing millions of dollars into farmland on both the Oregon and the Washington sides of the Columbia River Gorge. At current valuations, information technology's one of the nation's best farmland opportunities. In 2018, when 100 Circles sold, it was even better.

More oftentimes than non, farmland sales involve hundreds of acres. Thousand-acre transactions — such as the sale of half dozen,000- acre Weidert Subcontract to Farmland L.P. two years agone and the half-dozen,175-acre Broetje Orchards acquisition by the Ontario Teachers' Pension Plan last year — are blue-moon events.

Tens of thousands of acres? Only sovereign wealth funds and institutional investors tin can stroke a check for tracts in that league, which is exactly what occurred on the sell side of the 100 Circles transaction: The seller was John Hancock Life Insurance, a multibillion-dollar asset managing director with fundamental holdings in all the major US markets as well equally Canada and Australia.

The story went dark on the purchase side, however. The Tri-City Herald reported that the purchaser was a "Louisiana investor," a limited liability company associated with Angelina Agronomics of Monterey, Louisiana. Sorry, merely that didn't pass the sniff test.

The Land Report tracks numerous Louisiana landowners; Angelina Agriculture is not one of them. Let's telephone call that strike one. The burgeoning urban center of Monterey, population 462, rang a bell, but despite my all-time efforts, I couldn't connect the dots to anyone whom we had profiled in The Country Report or, for that affair, anyone who was on our scout list. So I took a look at Dun & Bradstreet. At its listed headquarters — 8318 Highway 565 — Angelina Agronomics boasted two employees and reported annual revenues just north of $300,000. Given the size and cost of 100 Circles, both of those figures fabricated no sense at all. Strike two. How about Google Maps? An aeriform paradigm of the Highway 565 accost revealed a small-scale metal-sided building off past itself in the woods. Strike three, right?

One of my favorite Clint Eastwood movies is the 1999 mystery/thriller True Crime. In information technology, the four-time Academy Award winner plays an over-the-hill journalist who has "a nose" for a story. I am quite confident that Eastwood'southward character, Steve Everett, would have picked upwardly the stench from this setup a mile off: a $171 one thousand thousand acquisition by an LLC with two employees in a metal-sided building down a dirt road off the Bayou Cocodrie? I forwarded the atomic number 82 to our Land Report 100 Research Team. Minutes later, a terse response arrived:

"Ever hear of Bill Gates?"

THE PROMISED LAND | Farmland in Eastern Washington and neighboring Oregon is blest with abundant moisture, inexpensive electricity, and unrivaled soils.

THE PAPER TRAIL

Actually, when it comes to the extensive farmland portfolio of Beak and Melinda Gates, the question should be, "Ever hear of Michael Larson?" For the last 25 years, the Claremont McKenna College alum has managed the Gateses' personal portfolio as well every bit the considerable holdings of the Bill & Melinda Gates Foundation. (Although our researchers identified dozens of different entities that own the Gateses' assets, Larson himself operates primarily through an entity called Pour Investment LLC.)

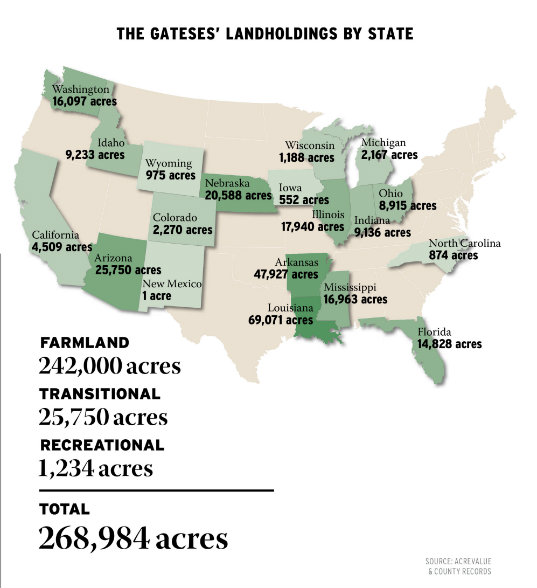

In 1994, the Gateses hired the former Putnam Investments bail-fund manager to diversify the couple'southward portfolio away from the Microsoft co-founder's 45 percent stake in the technology giant while maintaining comparable or improve returns. According to a 2014 profile of Larson in the Wall Street Journal, these investments include a substantial stake in AutoNation, hospitality interests such as the Charles Hotel in Cambridge and the Four Seasons in San Francisco, and "at least 100,000 acres of farmland in California, Illinois, Iowa, Louisiana, and other states … ." According to the Country Report 100 Research Team, that figure is currently more than twice that corporeality, which means Pecker Gates, co-founder of Microsoft, has an alter ego: Farmer Bill, the guy who owns more farmland than anyone else in America.

The Gateses' largest single block of dirt was acquired in 2017: a group of farmland avails owned by the Canada Pension Plan Investment Board. Based in Toronto, the Canada Pension Plan Investment Board began assembling an agronomical portfolio in 2013, when information technology acquired AgCoA, aka, Agricultural Company of America. This private US farmland REIT was a joint venture betwixt Duquesne Capital Direction and Goldman Sachs that launched in 2007. Over the next v years, AgCoA acquired more than 100,000 acres in nine states. By the time it was sold to the Canada Pension Plan Investment Board in 2013, AgCoA ranked as i of the leading institutional owners of row crop farmland in the U.s.a..

After AgCoA, the Canada Alimony Plan Investment Lath acquired a second tranche of farmland assets when information technology paid $ii.five billion for a 40 percentage stake in Glencore Agronomical Products in 2016. The very next twelvemonth, however, the Canada Pension Plan Investment Lath began shedding these very aforementioned farmland assets as rapidly as it had acquired them. And it did this and then quietly one might even say it was done in secret.

At that place was no public declaration, and no detect in the business printing. Instead, the Canada Alimony Plan Investment Lath revealed in the fine print of a quarterly argument that it had sold $520 million in US farmland assets held by Agriculture Company of America. Credit Chris Janiec at Agri Investor for this hawkeye-eyed investigating. The Americas Editor at Agri Investor, Janiec reported that the avails had been offered equally a single block and "that Microsoft founder Bill Gates is thought to exist the buyer of CPPIB'due south farmland." Janiec stayed on the story, and the following year, he confirmed the parameters of auction when he reported the addition of 61 properties valued at approximately $500 million to the National Council of Real Estate Investment Fiduciaries' (NCREIF) Usa Farmland Alphabetize. This one-half-billion-dollar figure corroborated the AgCoA acquisition, and the newspaper trail led directly to Cascade Investment LLC.

All told, the 2017 acquisition of AgCoA and the 2018 acquisition of the 100 Circles tract in the Horse Heaven Hills of Eastern Washington total an investment in farmland assets of more than $690 million. Janiec'south sources said some of the AgCoA assets were quickly sold off, but according to the Land Report 100 Research Team, an estimated 242,000 acres of farmland remained.

Yet farmland assets aren't the sole component of the Gateses' landholdings. In 2017, Pour Investment bought a "significant stake" in 24,800 acres of transitional country on the western edge of Phoenix, the most populous city in Arizona and the tenth largest metropolitan expanse in the country. The acreage sits off Interstate 10, and it is poised to be accessible by Interstate 11, a proposed highway that would traverse 5 miles of the 40-square-mile holding. At buildout, the Belmont evolution will create a brand-new urban center, 1 similar in size to the Phoenix suburb of Tempe, domicile to Arizona Country University and almost 200,000 residents. Co-ordinate to The Arizona Republic, Belmont is projected to include up to lxxx,000 homes; 3,800 acres of industrial, office, and retail infinite; three,400 acres of open infinite; and 470 acres for public schools.

Cascade Investment doubled down on Phoenix transitional land two years later when it made a second major investment by acquiring more than 2,800 acres known as Spurlock Ranch in Buckeye for $25 meg.

SUSTAINABLE INVESTING

A spokesman for Pour Investment declined to annotate on any of the details associated with these transactions or the Gateses' holdings, other than to say that Cascade is very supportive of sustainable farming.

Much like the Bill & Melinda Gates Foundation uses science and technology to achieve a number of worthy goals — including transitioning millions of people out of poverty, improving people's wellness and well-being, and ensuring that all people have admission to opportunities necessary to succeed in school and in life — Cascade's farmland holdings also aim to further laudable objectives.

In Jan 2020, The State Written report announced the launch of a sustainability standard that was adult by United states of america farmland owners and operators. Called Leading Harvest, the organization's goal is to create a sustainability standard that can exist implemented across the greatest swath of agricultural acreage. Currently, more than 2 million acres in 22 states and an additional 2 million acres in seven countries are represented. Among the participants in the 13-member Sustainable Agriculture Working Group are Ceres Partners, Hancock Natural Resources Grouping, The Rohaytn Group, and UBS Farmland Investors.

Non surprisingly, one of Leading Harvest's other countdown members is a Cascade entity called Cottonwood Ag Management. Committing the resources to launch this earth-shaking standard validates the assertion that Cascade supports sustainable strategies that advance resiliency and efficiency, retain talent, and reduce regulatory burdens.

Although the Bill & Melinda Gates Foundation has no ties whatsoever to Cascade or its investments, information technology also has a farmland initiative: Gates Ag I, which has established its headquarters in the Greater St. Louis expanse. According to the St. Louis Business Journal, Gates Ag 1 will focus on enquiry that helps "smallholder farmers suit to climate change and brand food production in depression- and heart-income countries more productive, resilient, and sustainable."

A Endmost Notation

Remember that metal-sided building downwards near the Bayou Cocodrie? Turns out that very same property had caught my center style dorsum when The State Report was preparing to launch in 2006. Does the name Bernie Ebbers ring a bell? One time upon a time, the business press dubbed the colorful entrepreneur "the telecom cowboy." That was before the Edmonton native was put on trial for his part in what was, at the time, the largest corporate bankruptcy filing in U.s.a. history.

In 2005, the former WorldCom CEO was convicted of securities fraud, conspiracy, and filing false reports that were instrumental in WorldCom's $eleven billion dollar accounting fraud. Afterwards losing his appeal in 2006, Ebbers spent well-nigh of the rest of his life in a federal prison before being granted compassionate release by a federal guess in 2020. He died at home surrounded by his family.

Ebbers was many things — a dreamer, a liar, a swindler — and he loved state. In 1998 when he was the toast of Wall Street, the telecom cowboy paid British Columbia'due south Woodward family the astronomical sum of $73 million for Canada's largest ranch: 500,000-acre Douglas Lake, a 22,000-caput cattle functioning. Ebbers subsequently pledged Douglas Lake every bit collateral for $400 meg he concluded up borrowing from WorldCom, and in 2003, WorldCom sold Douglas Lake to Kroenke Ranches. The $68.5 million that Kroenke Ranches paid was applied to Ebbers's IOU. He also endemic a 26,236-acre Louisiana farm. It, too, was sold, on September 25, 2006, the day before Ebbers began serving his judgement at the Oakdale Federal Correctional Institution. It was his final deal equally a gratis human.

When Ebbers owned this Louisiana farm, it was known as Angelina Plantation. And its headquarters was in — you lot guessed it — Monterey, Louisiana. That was the missing piece of the puzzle I had been searching for as I read the Tri-City Herald story. In a old life, Angelina Agronomics, the purchaser that paid $171 million for 100 Circles in 2018, was, in fact, Bernie Ebbers's Angelina Plantation. The day before he went to prison, Ebbers sold Angelina for $32 meg. The farm was subsequently sold to AgCoA, which was acquired by the Canada Alimony Plan Investment Board. In 2017, Angelina Plantation changed hands i more than time and became 1 of the chief farmland avails in the Gateses' Cascade Investment'south portfolio.

Information technology took a dozen years, but the ownership of that Louisiana farmland went from Bernie Ebbers to Neb Gates with a couple of stops in between. I readily acknowledge forgetting where and when I start defenseless current of air of it, but the moment I read that Tri-City Herald story, I knew the catastrophe definitely needed a rewrite. Steve Everett would be proud.

This article was updated to credit Wendy Culverwell as the reporter who broke the story of the Horse Heaven Hills transaction in the Tri-City Herald.

crispouressee1946.blogspot.com

Source: https://landreport.com/2021/01/bill-gates-americas-top-farmland-owner/

0 Response to "Credit Card Charge Reading Sp * Guiolp,wilmington,de,"

Postar um comentário